One NFL Franchise and the Realities of Betting in the Bible Belt

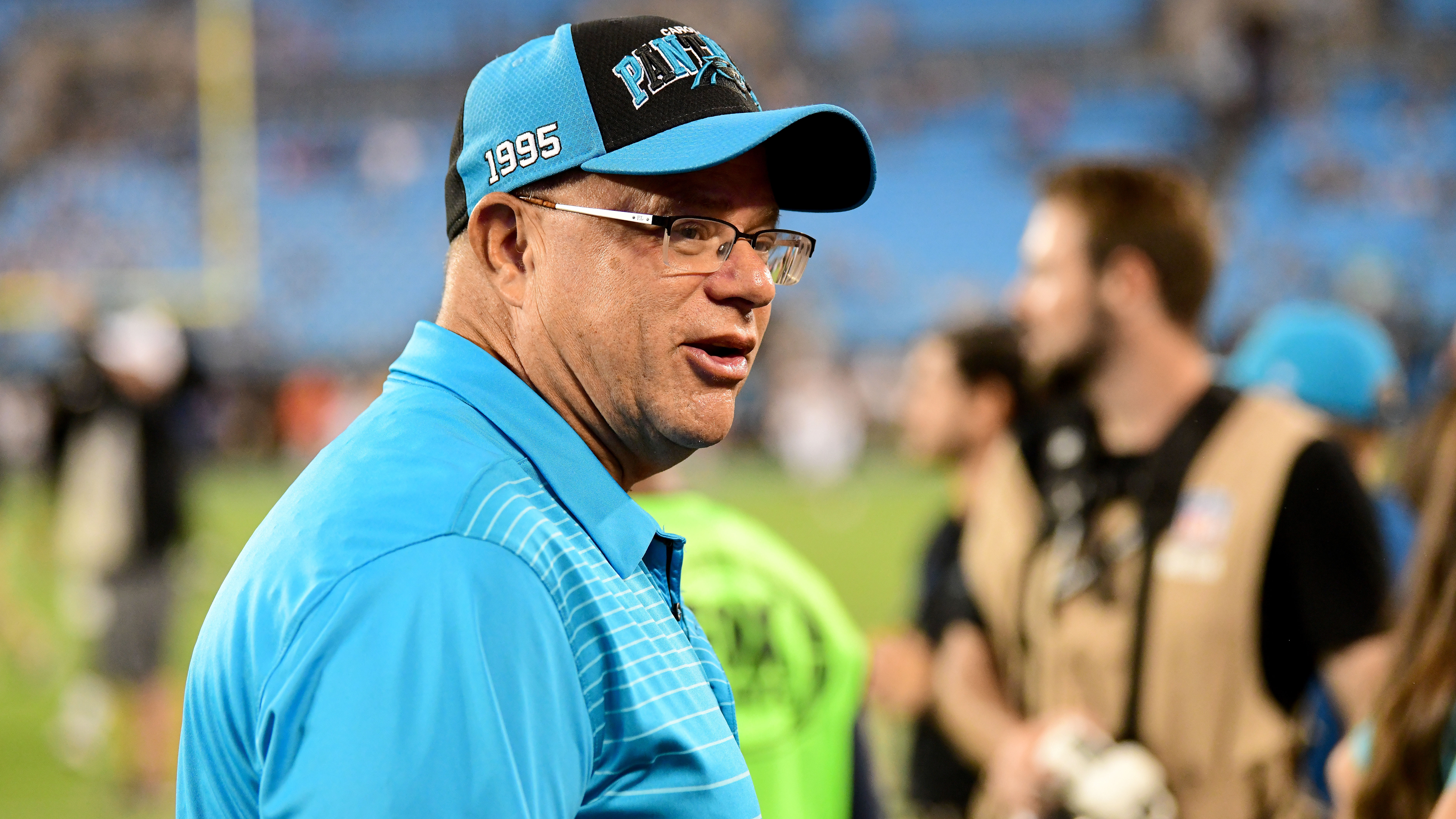

Two weeks ago, the South Carolina senate was debating what, if any, tax breaks the Carolina Panthers should receive if the team relocated its headquarters to the state. Meanwhile, team owner and hedge fund billionaire David Tepper was at a Charlotte high school, being honored for a donation he made to a boys’ basketball team.

It’s been a year since Tepper got NFL approval to buy the Panthers, and ever since he has been living the franchise’s “two states, one team” slogan. In 1995, the franchise played its inaugural season in South Carolina (at Clemson’s Memorial Stadium) while Bank of America Stadium was being constructed in Charlotte. Training camp has always been held at the alma mater of former owner Jerry Richardson, Wofford College in Spartanburg, S.C. But by bringing headquarters across the state line, Tepper is embracing the Palmetto State in ways unseen during the team’s 25-year history.

This is far from a philanthropic endeavor, of course. Tepper sees in South Carolina a state that could be more enthusiastic about its NFL team, and thus make his franchise more money. But one big reason why Tepper wants a presence in both states lies in the future of sports betting. In a sense, he’s hedging his bet on which state legalizes sports gambling first. Then, if and when both do, he could, in theory, double dip.

“Yeah I think it takes time, especially down here in the Belt,” Tepper, a Pittsburgh native who spent the majority of his professional career in New Jersey, tells The MMQB. “When other states around you do it, it’ll come. It becomes a revenue issue for different things they want to do in the states.

“People have to decide what they want to do and what’s right for them. And the New Jersey model is basically mobile phones everywhere and it’s raising a lot of money for the state, so people have to decide what’s important to them. Full stop.”

Tepper, the Panthers and the Carolinas are at the nexus of the benefits, concerns and unknowns surrounding sports betting. It’s where religion and morality are used to oppose sports gambling. Where others see an untapped revenue source and the need to fund local and state projects in two historically red states that want to avoid raising taxes. Where sports leagues and teams vie for their piece of a pie that is proving to be smaller than anticipated. Where a Native American tribe will be unwilling to cede its ground to outside forces—and within that a fight between tribes over ancestral land that could be developed for a casino just 30 minutes from where the Panthers play.

The specter of sports betting in the Bible Belt—and in these two states in particular—highlights the competing interests at play. The complexities and unique challenges mean this isn’t a slam-dunk, easy-money opportunity it seemed to be one year ago.

“I think that would be of some concern if [Tepper] was open to advocating for sports gambling,” say Joe Mack, a public policy official for the South Carolina Baptist Convention. “As Baptists we would oppose that. …This is not New Jersey.”

Outside of New Jersey, legalized sports betting has landed with a thud. Very few states are seeing the type of windfall that was expected a year ago following the Supreme Court decision.

According to an Associated Press report in April, four of the six states that have since legalized sports gambling saw lower-than-expected tax revenue. Mississippi and Pennsylvania are at about half their expectations, while West Virginia brought in less than a million dollars through six months—its first-year projection was $5.5 million.

“We’ve long said it: This is a low-margin business,” says Sara Slane, SVP of public affairs for the American Gaming Association. “In Nevada, if you’ve looked at the history there, [sports betting] was about 2% of their total gaming revenue. Obviously a teeny, tiny little fraction of what they were generating.”

On this front, states should be allowed a trial-and-error period. Part of failing to meet expectations has to do with states not taxing the games appropriately. The biggest reason, though, has been the lack of mobile betting offerings, ceding that market to offshore bookmakers. As one person interviewed for this story said, “If you can do it online, why would you go to a resort to do it?”

New Jersey has met expectations with $1.8 million in added revenue per month from sports gambling taxes, according to the AP, in no small thanks to mobile betting. But seemingly, across other states, a walk-jog-run approach is in place. First you allow sports betting in brick-and-mortar facilities and only on outcomes of games. Then you open up the prop betting. Then you widen it to mobile.

“It just depends on the sort of appetite for legislators to move down that path,” Slane says. “I would argue—and we have from an industry perspective—in order for us to compete, you have to have that mobile platform. If you want to have a successful sports betting model, that has to be a part of it.”

That message got through to one Bible Belt state. In late April, Tennessee voted to allow mobile sports betting without having any physical location to place bets in the state. Governor Bill Lee is staunchly opposed to gambling and won’t sign the bill into law, but it has enough support to pass without his signature.

And when it comes to gambling laws, when one state does it neighboring states soon follow. That was the case with the lottery, when states realized its residents would simply hop across the border to buy Powerball tickets—thus, another state’s education system was being funded by your state’s residents. If the prospect of additional revenue isn’t enough for lawmakers to pass sports betting in their own state, perhaps envy will be.

But even though states are still struggling to get rich off sports betting, they’re making more money from it than sports teams and leagues, who are trying—and failing—to get their piece of sports gambling. There are two main strategies: integrity fees and mandatory data requirements.

Slane says the NFL has, so far, been more closely aligned with the data requirements. The thought is, if you’re betting on NFL games or outcomes you should have official data across the board so as to be consistent. The producers and keepers of that data, leagues argue, should get paid for distributing trustworthy data.

“Our fear has long been if you create a statutory requirement that you have to buy data from the leagues you are essentially giving them a monopoly on pricing power,” Slane says. “And that could be very troublesome from a business perspective. You worry that prior to the Super Bowl, is the NFL going to jack up the data rates knowing that you’ve got to buy it?”

Integrity fees—which would be charged to sportsbooks or casinos then used to help govern and oversee this surge in gambling on games—have been struck down in courtrooms across the country. On April 26, representatives from the Panthers, Charlotte Hornets, Charlotte Motor Speedway and others met in North Carolina’s state capital to discuss possible integrity fees with the Eastern Band of Cherokee Indians, the tribe that operates the two Harrah’s casinos in the state.

“I don’t foresee that going anywhere,” says Eastern Band Chief Richard Sneed. “That hasn’t happened any place in the country. Our position on that is, it’s our responsibility to ensure the integrity of our games, and it’s their responsibility to ensure the integrity of their games.”

Sports betting appears to be coming down the pike in North Carolina. Republican state senator Jim Davis is sponsoring a bill, easily passed in the state senate, that would allow for sports betting on “Indian lands,” but only in-person and only on outcomes of games. Davis, whose district includes Cherokee County, says he wanted the Eastern Band to be able to expand and capitalize on what is now legal.

“It’s a very narrowly tailored bill to apply only to properties held in trust,” says Davis who, of 11 publicly elected officials in the Carolinas contacted for this story, was the only lawmaker to respond and agree to speak on the record. “Whether or not the state is ready for it, we’ll just have to wait and see.”

In 1997 the Cherokee launched their first Harrah’s casino on the Qualla Boundary, about three hours west of Charlotte in the Appalachian Mountains. They opened a second casino in 2015 at the western tip of the state that can be accessed by a short drive from Tennessee, Georgia and South Carolina.

The gaming industry has been the economic lifeblood for the tribe for the past two decades, helping fund a public school, hospital, rehab center and more for the Cherokee. And while Chief Sneed welcomes the sports betting bill, he understands it won’t be a huge revenue booster for the tribe.

“We’re going off numbers coming out of Vegas because we’re with Harrah’s which is an entity of Caesars,” Chief Sneed says. “They told us, at best, 5% of your gross gaming revenue. You just don’t make a lot of money off it. That’s why I continue to use the term ‘added amenity.’”

Keeping sports gaming confined to a brick-and-mortar casino is probably the “safest” way to go about it, but again, no one gets rich off it. And each time you take a step to more gaming, the stakes are increased.

Ted Leonsis, owner of the Washington Wizards and Capitals, plans to open a sportsbook within Capital One Arena after D.C. approved sports gambling last December. The sportsbook would be accessible from the outside and, potentially, from the inside during events, as well. If and when that happens, be it in D.C. or elsewhere, how does a team square its arena being a family-friendly environment while simultaneously housing a gambling operation?

Bill Sutton, a sports business professor at the University of South Florida, offers a hypothetical: You go to a game with your 8-year-old son. He sees the sportsbook and urges you to go make a bet on the outcome of the game that favors the home team. You go in, make the bet and let him hold the slip through the game.

“And he’s going to root for the outcome of that slip to be paid,” Sutton says. “By making it fun and making it recreational and sensible, you’re going to encourage gambling at a much younger age. Now you have to figure that piece out too.”

Then there’s the moneymaker. Legalized mobile gaming will capture the most bettors, thus bringing in more revenue for all involved. But could it be too ubiquitous?

“The mobile betting to me is the most precarious because then you can gamble literally anywhere,” says John Grady, a sports law professor at the University of South Carolina. “You don’t have to restrict it to a place of gambling where you have extra control or where you can keep children out. Then you can go gamble in your grocery store, I suppose.”

Which is similar to what was happening in South Carolina 20 years ago. The state now has an education lottery, but just four years ago South Carolina had to pass a constitutional amendment for churches to even hold raffles. Today, any South Carolina adult will remember the video-poker craze that ran rampant in the state during the ’90s, when machines could be found at just about any gas station or highway exit.

At one point, there was one video poker machine for every 100 South Carolinians. It became a multi-billion dollar industry in the state, but there was a cost. In August 1997, 26-year-old mother Gail Baker left her 10-day-old daughter in the car for seven hours while she played video poker. Joy Baker’s death became a symbol of the sins of video poker, and within three years the machines were banned in the state.

[image:14377911]

“In most cases, a lot of the people who are doing these things are people who can’t afford to do them,” says Mack, the South Carolina Baptist Convention official. “They’re using grocery money or power bill money to gamble with. And that was certainly the case with video poker.

“Our churches were flooded with people saying help me pay my rent, my light bill. … Mothers whose husbands had gambled away money and couldn’t pay the rent or couldn’t buy food. It was a chaotic, disastrous thing.”

There is next to no movement in South Carolina for sports betting at this time. There are bills in the South Carolina House and Senate that would amend the constitution to allow sports betting, but they’ve gotten no traction. Governor Henry McMaster’s spokesman called the House bill “a loser” that’s “inconsistent with the core beliefs” of the state’s residents.

So if South Carolinians want to bet on sports any time soon, they’ll have to do it illegally or drive into the North Carolina mountains. But there may be a new option coming—one that’s just across the border, a half-hour from Charlotte.

On the first day of May, as the Senate Judiciary Committee grilled U.S. attorney general Bill Barr on the Mueller report, South Carolina Senator Lindsey Graham used a break in the action to hustle over to a Committee on Indian Affairs hearing.

Graham, along with two North Carolina U.S. senators, is sponsoring Bill S. 790, which would give South Carolina’s Catawba Indian Nation the ability to take North Carolina lands into trust for the purposes of gaming.

“Well, compared to where I’ve been this is a real pleasure,” Graham started. “… I have never seen anything as difficult as land issues involving Native Americans. This is really a complex area of the law.”

The Catawba have, for the better part of a decade, been trying to pull themselves out of what Chief Bill Harris calls “federally enforced poverty” and build a casino resort in North Carolina that would straddle the state border and be about 20 interstate exits away from Charlotte-Douglas International Airport.

A tribe based in Rock Hill, S.C., the Catawba are looking to take the North Carolina land that they claim as their aboriginal land. The tribe would develop a 220,000-square foot casino and resort on 16 acres that, according to Harris and others, would bring 4,000 jobs and untold millions of dollars of revenue and development to an economically depressed area while helping bring the tribe out of its dire financial straits.

But South Carolina wouldn’t see a cent of direct revenue from this project, so what is Graham doing spearheading this bill? That’s in the eye of the beholder. On one side he’s helping a tribe, with only 1,000 acres of land and piles of broken promises from the federal government, get its casino in the most direct way possible since the state of South Carolina would never allow it.

On the other side, a direct link takes shape. When Graham ran for President in 2016, Wallace Cheves served on his national finance committee. Cheves, who has been in the gaming business for 24 years, operates Sky Boat Gaming, which has been developing this casino with the Catawba since 2008.

“He’s been extremely instrumental because Lindsey’s known the Catawba tribe a lot longer than he’s known me,” Cheves says. “When I was [in college] he was being instrumental to the tribe. He has taken the lead on this and has really tried to bring economic development for them—not just in gaming. He sees the benefit of the greater development that can happen at this corridor.”

And that’s just one strand in this political web. Thom Tillis, a U.S. senator from North Carolina co-sponsoring this bill for the Catawba, expressed “serious opposition” to this same casino in a 2013 letter when he was state’s speaker of the house. At the hearing, no one grilled the Catawba more than Senator Catherine Cortez Masto, a first-term Democrat from Nevada where Caesars is one of the state’s largest employers. And on Monday, 38 of North Carolina’s 50 state senators signed a letter delivered to the Indian Affairs Committee stating their opposition to the Catawba casino.

Three weeks after the hearing, no one interviewed seems to know what exactly the next step is or when it will happen. Cheves says they’ve done so much pre-planning that if this bill passes in 2019, they could have casino games starting as early as 2020. That’s best-case scenario for the Catawba, one that hopes slight tweaks to the bill’s language will pass through the Senate and be signed off by President Trump. There’s also a possibility that, because of older settlement acts between the federal government and the Catawba and the complex Indian Gaming Rights Act, the casino could be a decade and millions of dollars away from happening. Or not happen at all.

“Will this mean that if this bill doesn’t go through Catawba will perish? Um, no,” Chief Harris says. “We’ve been around for 6,000 years. We’re not going to just dry up and go away. But when you have the ability to put 4,000 jobs in an economically depressed area, how can anybody be opposed to that?

“I don’t wish to have anything less or more than what the Cherokee have.”

The Catawba casino would eat into the profits of the Cherokee, who have enjoyed a virtual monopoly on legal gambling in North Carolina (outside of the lottery) for a quarter-century. Naturally, Sneed and the Eastern Band have issued strong opposition, and he was in Washington, D.C., for May’s hearing. A casino miles from the largest city and airport in the Carolinas would represent, at worst, a 30% reduction in revenue for the Cherokee, Sneed says. Someone looking to gamble legally has far less incentive to wind through the Appalachian Mountains to find a casino if the Catawba one exists.

“My position has been if Senator Graham says, ‘We’re trying to help this poor tribe in South Carolina,’ well, fix it in South Carolina,” Sneed says.

The tribes, politicians and developers all have an obvious vested interest in what happens here. But Tepper and the Panthers are also keeping a close eye on what’s happening.

“The main thing I’m concerned about if there’s [sports] gambling in the state, that there’s not a casino five minutes from my stadium,” Tepper says.

If Sen. Graham’s bill is approved, and if the state bill on sports-betting on tribal land gets through the legislature, that’s exactly what will be happening 30 minutes from his stadium.

“[That would] concern me,” Tepper says. “I want people in my stadium. That’s No. 1.”

Dick Harpootlian, a first-term Democratic state senator, spent the morning of May 7 on the South Carolina senate floor explaining to his colleagues that the proposed new Panthers headquarters in South Carolina—think of Frisco’s The Star, but on a smaller scale and (maybe) eventually with a sportsbook by the time of completion in 2022—won’t be nearly the cash cow it’s been made out to be.

He had hired an economist with his own money, and she figured that the $3.8 billion economic-impact estimate over 15 years that the state devised for the Panthers’ facility had been inflated by at least $2.7 billion.

Surely, Harpootlian argued, this wouldn’t be worth the $115 million in tax breaks the state would be offering the Panthers to move, especially since Tepper wanted the South Carolina facility and North Carolina had no tax-break bill on the table to compete with.

“This is a bad deal for South Carolina,” Harpootlian said. “This is a great state. We shouldn’t have to bribe people to come here.”

Two days later, the South Carolina senate passed the incentive package with a 27-15 vote. The Palmetto State will have a permanent professional football resident, even if there’s never a single NFL football game played there.

The episode showed how lawmakers, even with leverage and verifiable data, can kowtow to sports teams and leagues in the name of economic impact. Sure, call Tepper’s bluff, vote against the bill and see if he moves to South Carolina for nothing. But if you’re wrong and Tepper wasn’t bluffing, good luck in re-election when you’ll be painted as the senator who cost the state its shot at pro football.

The NFL is usually one of the biggest players at any table at which it sits. Though the league hasn’t fully launched its plan to get a bite at the sports-gambling apple, it stands to reason Tepper, with his numbers skills and his hedge fund’s bets on casinos, would be heavily involved in the league’s next steps.

A powerful tool like a pro sports team or league has been known to exert its influence and shift political winds. As recently as two years ago in North Carolina, after the NBA pulled the All-Star Game and the NCAA yanked tournament basketball out of the state, lawmakers who had fear-mongered their way to pass a discriminatory “bathroom bill” walked part of it back.

Will the lawmakers think of the children they purport seek to protect if and when they allow a sportsbook to open in a stadium, or make betting available anytime, anywhere via mobile gaming? What of the poor, oppressed Native American tribes they say they want to help when the billionaire sports owner looks for a gaming license or crippling data fees?

“I think [Tepper’s] influence is significant because he controls a large economic engine of at least two states now,” says Grady, the USC professor. “He’s an external driver. In this legislative debate, an external driver is the kind of force to move public perception or legislative action. He does have that kind of momentum to move it forward to minimize negative attitudes that legislators might have.”

So, who wants to bet against him?

• Question or comment? Email us at talkback@themmqb.com.